In recent years, sustainable finance has gained prominence as an approach to finance that goes beyond the goal of maximizing profit to contributing to a fairer and more environmentally conscious world. This approach recognizes the interconnection between financial success, social responsibility and environmental preservation. In this article, we will explore what sustainable finance is, why it is important and how individuals and companies can participate in this global movement for a more sustainable future.

What is Sustainable Finance?

Sustainable finance, also known as socially responsible investing (SRI) or impact investing, is an investment approach that considers not only the financial return, but also the social and environmental impacts of investment decisions. They seek to align financial capital with ethical values and environmental concerns.

This approach involves allocating financial resources to companies, projects and initiatives that promote sustainable business practices, respect human rights, minimize environmental impact and contribute to solving social problems such as poverty and inequality.

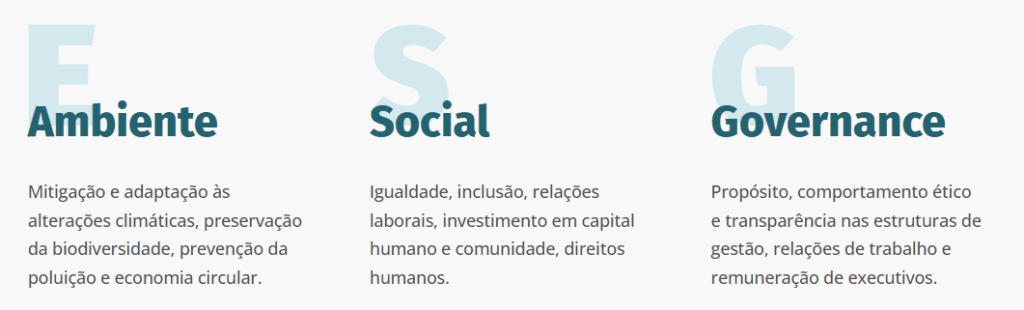

Sustainable finance represents a new paradigm in financial practices, an approach aimed at redirecting financial flows towards sustainable investments, which takes into account environmental, social and governance (ESG) aspects. In the political context of the European Union (EU), sustainable finance is understood as a vehicle for supporting economic growth, while simultaneously reducing pressures on the environment and considering social and governance aspects.

Why is Sustainable Finance Important?

How to participate in Sustainable Finance

Application of ESG Criteria: ESG (Environmental, Social and Governance) are criteria used to evaluate the sustainable performance of companies. Consider these criteria when making investments.

Impact Financing: You can direct your capital towards impact investments, which actively seek to solve social or environmental problems, such as renewable energy or quality education.

Active Participation: Shareholder actions and involvement with companies that can positively influence corporate policies towards sustainability.

Sustainable finance not only represents a responsible financial approach, but is also essential for face the global challenges of our time, such as climate change and inequality. By incorporating environmental, social and governance considerations into your financial decisions, we can play an important role in building a more sustainable and equitable world.

By investing consciously and supporting companies committed to sustainability, we are investing in the future of our planet and of business.

- In BUYME Businesswe are committed to guiding your company towards a more sustainable financial future.

Leave a reply